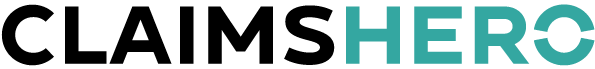

Unravelling the Complexities of Mould Claims: Your Guide to Success

Mould is more than an unsightly inconvenience. It can be a serious health hazard and lead to substantial property damage. As such, it often forms the basis of insurance claims. Mould claims can be very complex and prone to declinature by your insurer. Here’s your guide to navigating the murky waters of mould claims, ensuring your claim’s success and avoiding common traps. […]

Navigating Storm Claims: A Guide

As we’re all too aware, the elemental force of a storm can leave a trail of destruction in its wake. With damaging winds, torrential rains, and hail, storm-related damage in Australia can be a frequent occurrence. Navigating the storm damage claim process might seem daunting, but armed with the right knowledge and preparedness, you can […]

The Hidden Challenges Of A Home Fire Claim

A home fire can be a devastating experience for any Australian homeowner. Not only can it cause significant damage to the property and personal belongings, but it can also have a lasting emotional impact on those affected. In the aftermath of a home fire, navigating the claims process can be complex and stressful, with several […]

Navigating Delays: A Guide to Dealing with Insurance Claim Delays in Australia

Dealing with insurance claims can be a difficult process, especially when you’re faced with delays. These disruptions can lead to stress, frustration, and financial strain for policyholders. In Australia, insurance claim delays are not uncommon, and being prepared to navigate them is essential for a smooth resolution of your claim. In this blog post, we will provide […]

Check Your PDS – Are You Really Covered On What You Think?

Product disclosure agreements are a common legal requirement for insurance companies. These agreements aim to provide transparency and protect consumers, but there are potential risks and considerations specific to insurance that should be taken into account before signing. A potential risk is the possibility of misleading or incomplete information in the product disclosure agreement. Insurance […]

Has Your Insurer Denied Your Claim?

Insurer Denied Your Claim? If an insurer has declined your legitimate claim, it can be frustrating and overwhelming. However, there is no need to hit the panic button. There are steps you can take to challenge their decision and attempt to receive the compensation you are entitled to. Pre-existing damage, maintenance issues and non-insurable events […]

Navigating The Complaint Resolution Process with AFCA

The Australian Financial Complaints Authority (AFCA) is a free and independent, external dispute resolution (EDR) scheme that resolves complaints made by consumers and small businesses regarding general insurance products in Australia. AFCA handles a wide range of general insurance complaints, including but not limited to: When a customer makes a general insurance complaint to AFCA, […]

Our Top 10 Tips For Cash Settling Your Insurance Claim

When it comes to settling a claim with your insurer, you may have the option to receive your payment in cash instead of having repairs made or replacement items provided. This is known as a “cash settlement.” There are a few reasons why you might choose to cash settle with your insurer. For example, you […]