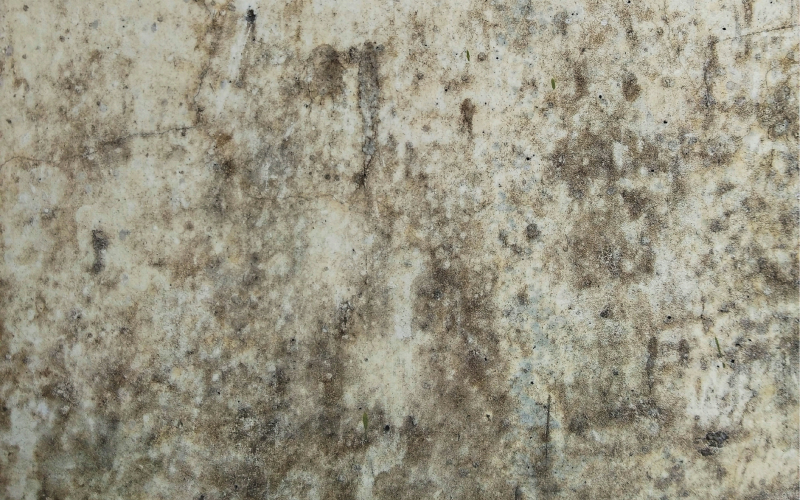

Mould is more than an unsightly inconvenience. It can be a serious health hazard and lead to substantial property damage. As such, it often forms the basis of insurance claims. Mould claims can be very complex and prone to declinature by your insurer. Here’s your guide to navigating the murky waters of mould claims, ensuring your claim’s success and avoiding common traps.

What Are Mould Claims

Mould claims are insurance claims made when mould growth, typically due to water damage or high humidity, leads to property damage or personal health issues. These claims are made against a homeowner’s or renter’s insurance policy. However, it’s crucial to note that not all policies cover mould damage, and coverage often depends on the cause of the mould.

Steps to a Successful Mould Claim

1. Recognise the Potential Causes: It’s crucial to understand which events might lead to a mould issue, as this is the first step to making a successful claim. Common incidents that often give rise to mould include events like flooding, pipe leaks, and storm damage. These occurrences typically increase the moisture levels within a property, creating a conducive environment for mould growth. By recognising these situations and acting promptly, you can mitigate the damage and strengthen your position when making a mould claim.

2. Document the Damage: As soon as you notice mould, start documenting. Take clear, detailed photos and make notes of where the mould is located, when you first noticed it, and any damage it’s caused. This serves as your initial evidence.

3. Notify Your Insurance Company: It’s essential to notify your insurance company as soon as possible. They may require you to fill out specific forms or provide additional information.

4. Consider Alternate Accommodation: Mould infestations can pose serious health risks due to their toxicity. If you’re facing such an issue and your insurance policy includes coverage for alternate accommodation, it’s highly advisable to consider temporarily relocating while the mould remediation process is underway. This can protect you and your family from potential health hazards and ensure a safer living environment until your home is fully restored.

5. Professional Assessment: Get a professional mould assessment. A qualified expert can determine the extent of the mould, the damage caused, and the necessary remediation steps. This information is often critical in supporting your claim.

6. Mitigate Further Damage: While waiting for your claim to process, it’s your responsibility to prevent further damage. This might mean addressing leaks or other sources of water intrusion, or even undertaking temporary mould cleanup.

7. Keep a Record of Expenses: Any costs incurred, from assessment to mitigation, should be thoroughly documented with receipts. These can be reimbursed as part of your claim.

8. Claim Submission: Submit your claim with all the supporting documentation. It’s a good idea to keep copies of everything you send in case you need to reference it later.

9. Negotiate the Settlement: If your claim is approved, the insurer will either undertake the repair or propose a settlement amount. You have the right to negotiate this, especially if you believe it doesn’t fully cover your losses.

Common Traps to Avoid

1. Neglecting Maintenance: Most insurance policies exclude damage due to neglect or poor maintenance. If mould forms because of an ongoing leak you didn’t address, your claim may be denied.

2. Failing to Notify the Insurer Promptly: Delaying notification can give insurers grounds to deny the claim, especially if they believe the delay worsened the damage.

3. Insufficient Documentation: Without strong evidence of the mould and its impact, insurers may minimise the extent of the damage or deny the claim altogether.

4. Ignoring the Source of the Mould: If the source of the mould isn’t addressed, it will likely return after remediation. This could lead to future denied claims as insurers may consider it a recurrence of the same issue.

5. Environmental Mould: It’s important to understand that insurance policies usually necessitate a direct connection between mould growth and an identifiable, insurable event, such as a burst pipe or severe storm. If mould develops due to environmental conditions — say, high humidity or natural, gradual deterioration — and not as a direct consequence of a covered incident, it’s typically excluded from coverage under the policy. In saying this, sometimes extended rain events can be considered a ‘storm’ for the purposes of insurance policies so it’s always good to get a second opinion if your mould claim has been declined.

6. Navigating Repair Warranties with Insurers: When mould damage is deemed to be caused or exacerbated by maintenance issues at your property, insurers often refuse to undertake the repairs. Instead, they may opt to offer a cash settlement. However, it’s crucial to understand that when an insurer chooses to cash settle, they are obliged to pay you an amount that reflects the actual cost you are likely to incur in undertaking the remediation. This amount can often be significantly higher than what it would have cost the insurer to carry out the repairs. Therefore, it’s wise to obtain your own repair quotes and ensure the insurer is accounting for contingencies related to the risk transfer.

Navigating mould claims can indeed be complex, but having a clear understanding of the process and potential pitfalls is a crucial step towards ensuring a successful claim. That’s where Claims Hero can step in to help. With our extensive experience in handling mould claims, we can guide you through each stage of the process. We’re committed to helping you avoid common traps and ensuring that you receive the compensation you’re entitled to. Remember, you don’t have to face these challenges alone – Claims Hero is here to support you every step of the way.

Note: This blog post provides general information only for educational purposes and does not take into account your specific circumstances. You should seek professional legal or financial advice tailored to your personal situation before making any decisions or taking any action based on the information provided in this blog.